Abstract

The purpose of this paper is to analyze Tesla’s strategy for ensuring its own sustainable future growth while acting as a catalyst of change in the automotive industry. The paper utilizes document analysis as a main method, with the presentation of the results in a case study format. It was realized that Tesla has managed to create a product that has a rather unique positioning in a highly competitive industry. However, Tesla was unable to capitalize on the potential demand regardless of the superiority of its products, as the current market leaders have a considerably lower price and are competing with a different class of vehicles altogether. The implications for industry development are discussed in connection with competition in the hybrid electric vehicle and battery electric vehicle categories.

1. Introduction

Tesla is an important innovator in the electric vehicle industry. It is a modern and potentially disruptive entity that has entered the automotive sector, where it benefits from centuries of research and development. Moreover, it leverages significant funding and advancements in technology to create cutting-edge electric vehicles. This approach not only positions Tesla as a leader in the market but also challenges traditional automotive manufacturers to adapt to the changing landscape of transportation.

2. Methodological Approach

This paper aims to provide an effective analysis of the current position of Tesla Motors in regards to the company’s competitive advantage in a global context. An industry analysis was undertaken followed by an analytical breakdown of the influences in the current internal and external environments, with the focus on factors that affect the firm’s strategy. A framework is developed to facilitate a better understanding of the opportunities for strengthening the company’s positioning, supported by the discussion of practical implications for industry development in regards to competition in the hybrid electric vehicle and battery electric vehicle categories.

Firstly, a concise overview of the company is provided including a brief history focused on how the company came to be one of the leading innovators in the electric vehicle and energy storage industries. Following this, an overview of the industry is presented in addition to a summary of Tesla’s partnerships, main competitors and strategic options. The discussion of practical implications aims at raising competitiveness of the company and is structured around the latest research in the automotive industry and the emerging electric vehicle market.

2.1. Scope and Limitations

Although Tesla Motors offers a range of products, including electric vehicles, automotive components, and rechargeable energy storage systems, this report primarily focuses on the automobile industry. Furthermore, the analysis of the internal environment will not extend beyond the examination of the company’s current offerings and target market, as there is limited publicly available data regarding the firm’s strategy. Since Tesla’s products in this sector compete with fossil fuel, hybrid, and battery electric vehicles, the report will also include information about the automotive industry as a whole to illustrate the potential growth of this market sector in the coming years. The data will primarily concentrate on the U.S. market for ease of comparison.

3. The Company

3.1. History and Ethos

Tesla is a technology company based in the US, established in 2003, that specializes in manufacturing automobiles and selling automotive components and energy storage devices, primarily utilizing its own patented technology. The company’s auto-manufacturing division sets itself apart from traditional industry players by addressing the environmental issues linked to fossil fuel-powered vehicles. They argue that an excessive focus on developing combustion engines has stifled progress in alternative fuel powertrain technologies (Tesla Motors, 2015; Musk, 2015). Consequently, Tesla is dedicated exclusively to advancing battery electric vehicles, while larger companies in the sector continue to invest significantly in hybrid, plug-in hybrid, and alternative fuel cell vehicles.

3.2. Value Preposition

The company’s value proposition is based on offering a luxury car that boasts specifications comparable to high-end luxury vehicles, while alleviating the environmental concerns associated with excessive pollution. Furthermore, it promotes greener driving without sacrificing performance, as electricity tends to be more affordable than fossil fuels in many markets. Electric vehicles also feature fewer moving parts compared to their fossil fuel counterparts, which is often considered to lead to lower servicing and maintenance requirements. This makes them more cost-effective to operate over the product’s lifespan (Chan and Wong, 2004).

3.3. Strategic Concept

The company’s original plan was to follow the typical patterns of product life cycles in the technology industry. They wanted to fund the research and development of new products using the sales from previous products. Tesla aims to achieve this by implementing a three-stage development strategy for its products, which aligns with Roger’s (2003) Diffusion of Innovation Theory.

In the first stage, Tesla targeted innovators with the Tesla Roadster, an expensive and high-performing electric sports car with limited production. This was followed by the Model S, a mid-priced sedan with moderate production levels, which was designed as a more practical car to further appeal. According to Rogers, the innovators have more or less embraced the concept of green cars within the USA as figures suggest that HEVs, PHEVs and BEVs have an adoption rate of just over 2.5% (Cobb, 2015).

The soon to be released Model 3, an affordable relatively low-priced automobile which will be produced in high volumes, is aimed at targeting the early adopters as the technology becomes more widely accepted and the benefits versus cost of adoption is more widely understood (Rogers, 2003; Musk, 2006).

The company implies that if you are purchasing any model of Tesla automobile you are investing in the development of future models and consequently making green technology more affordable, which further adds value to the idea of purchasing a Tesla product.

The firm has slightly deviated from this strategy presumably in order to adapt to customer demand within the market and have developed the Model X, a utility vehicle which recent trends suggest have grown in popularity and have overtaken sedans as the most popular body type of new vehicle to be registered in the USA (IHS Automotive, 201.

The company sets itself apart from the typical dealership model that dominates the US automobile market by integrating its sales operations. Traditionally, automobile manufacturers have to sell their products through third-party dealerships and franchises (Bodisch, 2009). However, Tesla encourages online sales and is the only car dealership that has established methods for direct customer sales.

In states where the direct sale of cars by auto manufacturers is illegal or restricted, Tesla has opened “Galleries” with the intention of providing a space for potential customers to view the product before purchasing it online. This move has faced criticism from lawmakers and other manufacturers, but Tesla’s unique position appears to be stable as other manufacturers are adopting similar sales models (Read, 2013).

This issue is specific to the US market due to its distinctive car sales model, but it is significant as it is currently Tesla’s largestCopy

3.4. Important Partnerships

Daimler AG, best known as the maker of Mercedes vehicles acquired a financial stake in Tesla in 2010 with the notion of collaboration “on the development of battery systems, electric drive systems and on individual projects” (Tesla Motors, 2015). This included the development of battery packs and charging equipment for the Smart Fortson and the Mercedes-Benz A-class.

Toyota Motor Corporation, the world’s biggest automaker had similar partnership arrangements with Tesla. After acquiring a financial stake in the company, Toyota had Tesla develop powertrain systems for its RAV4 Program me. Tesla acquired a large manufacturing facility for bellow the market rate from Toyota as part of the partnership agreement, which entitled Tesla to federal loans given to companies developing emissions free, high efficiency vehicles. Both these partnerships both came about at extremely important times for Tesla as they were worth a considerable amount financially and Tesla was able to capitalize on this and invest heavily into developing its product range (Trudell and Osman, 2014; Tesla Motors, 2014).

Tesla has an ongoing strategic partnership with Panasonic, a leading company in battery technologies, where they are cooperating on the construction of a facility known as the Gig factory. The strategic value of this partnership is extremely high as the purpose of the facility is to insure the continuous supply of battery components in order to meet the rising demand for Tesla vehicles, in addition to innovation and cost reduction of the components for use in future Tesla models aimed at the mass market (Tesla Motors, 2014a). The Gig factory will be operational by 2020 and will be working to supply batteries for an estimated 500,000 Tesla cars per year whilst working at 30% capacity. There is scope and willingness from executives to further expand the site by 50 to 100%, making the Tesla, Panasonic partnership the largest manufacturer of lithium-ion fuel cells (Cuthbertson, 2014; Tesla Motors, 2014b). Additional information regarding Tesla’s strategic partnerships can be found in the table Copy

Table 2: Overview of Partnerships

| Partner | Type of Partnership | Purpose | Synergy |

|---|---|---|---|

| Daimler AG (2007-2014) | Strategic partnership | 1) Collaboration on projects 2) Knowledge sharing 3) Supply agreement | High level of synergy, indicating a successful partnership. |

| Toyota Motor Corporation (2010-2015) | Investment | 1) Collaboration on Toyota RAV4 EV 2) Knowledge share 3) Supply agreements | High level of synergy, indicating a successful partnership. |

| Panasonic corporation (2014-Present) | Strategic partnership | 1) Battery research and Development 2) Gig factory | N/A |

| Airbnb | Investment | Expand charger availability | Medium level of synergy indicating considerable benefits to both parties. |

4. Industry Analysis

4.1. Overview

Tesla Motors competes in a specific segment of the automotive industry. Since the financial crisis, the auto industry has experienced significant growth in demand, with many manufacturing companies vying for lost market share.

Market Growth and Vehicle Sales

In 2014, around 7.9 million vehicles were sold in the U.S. market, reaching sales figures not seen since 2002 (Autoalliance, 2015). This growth can be attributed to various factors, including:

- Raising oil prices: The increase in oil prices in 2008 made consumers more conscious of fuel consumption, leading to a rise in demand for sustainable and highly efficient cars (Economist, 2009).

- Luxury model sales: Sales of luxury models have outpaced overall industry growth rates by 2.8% in the first quarter of 2015 in the USA. This could be linked to the decline in crude oil prices, resulting in cheaper petrol (Murtha, 2015).

Current Leaders and Competition

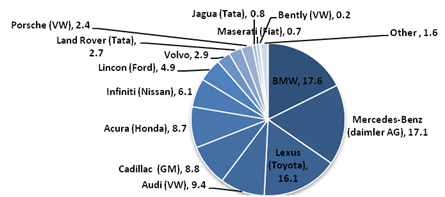

Currently, BMW and Mercedes are the frontrunners in the luxury car market in the United States. However, they are facing growing competition from other brands such as Lexus and Audi.

Figure 1: Luxury Car Market Share % by Brand 2014

Source: GoodCarBadCar, 2015

The demand for hybrid and battery electric cars has seen considerable global growth in recent years with many companies capitalising on this trend and investing heavily into the new technology. This seems to be in line with fluctuations of oil prices, access to government loans for the purpose of investing in renewables and government subsidies for customers purchasing electric cars.

In 2014 and so far in 2015 the demand for hybrid and electric cars has declined in the USA (EDTA, 2015). This may be due to decreasing oil prices and therefore cheaper access to fossil fuels or customer’s apprehensions regarding the current specifications of electric cars; more specifically the overall time in which it takes to refuel the cars and their range respectively. The European market continues to see a rise in demand for electric vehicles, likely due to the fact that fuel is more heavily taxed in Europe than the USA (Piper, 2015). In addition to this, there has again been increased interest in automobile emissions in recent months due to controversy and alleged fraud by industry giants regarding deasil emissions this may have an impact on sales of hybrids and battery electric vehicles but this is yet to Copy

The Roadster is a high-performance car that is no longer in production and shall therefore be ignored in this report. The Model S and Model X are both full-sized, luxury vehicles and the Model 3 is a small luxury vehicle.

All Tesla cars are battery electric vehicles which effectively means they are in a unique position in the market as other manufacturers of this vehicle type have so far focused on family vehicles and compact city vehicles. Due to the high price and luxury nature of the Model S and the Model X they naturally find themselves competing with other full-sized premium sedans and SUVs.

Tesla’s reputation and the low environmental impact of its cars means that they also effectively compete within the markets for hybrid electric vehicles, plug-in hybrids and the aforementioned companies who currently only offer compact city cars and superminis as battery electric vehicles.

The three main markets in which Tesla competes in are therefore:

- Eco car markets which include plug-in electrics and hybrid vehicles

- Market for luxury sedans

- Market for SUVs

Libby (2013), used information from new vehicle registration data within the United States of America and created a report illustrating the diversity within Tesla’s buyer group. The following table to show what Model S buyers owned at the time of purchase.

The data does not stipulate whether the buyers were purchasing the Model S with the notion of disposing of the original vehicle and this data must therefore be used with caution. However, this table supports the notion that Tesla Motors has innovated to the extent that they have effectively created a product that competes across various markets and against various technologies.

Additional information given in the report supports this, listing several hybrid Toyota models and the Nissan Leaf, a plug-in electric car, as some of the most frequent models owned by Model S buyers (Libby, 2004).

The competitors have been identified by analyzing Tesla’s Model S buyer group and recent sales data of various eco-friendly cars over the previous 6 months and separated into the relevant Copy.

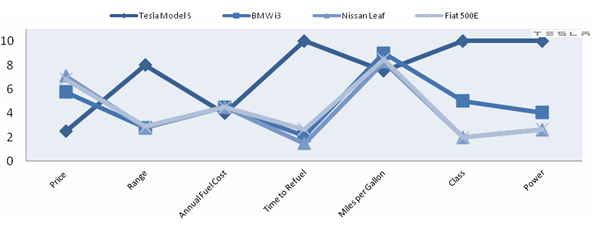

4.2.1. Tesla Model S vs Main Battery Electric Vehicle Competitors (BEVs)

Figure 2: Product Value Curve Tesla v BEVs

Source: Office of Transportation & Air Quality, 2015

Battery electric vehicles have some flaws that make people hesitant when thinking about buying them. It’s clear that the Tesla Model S has a significant advantage over its competitors in terms of range, refueling time, class, power, and fuel costs. However, despite having a better product, Tesla is unable to fully take advantage of the potential demand because the current market leaders have much lower prices and are competing with a different type of vehicles together.

4.2.2. Tesla Model S vs Main Hybrid Electric Vehicle Competitors (HEVs)

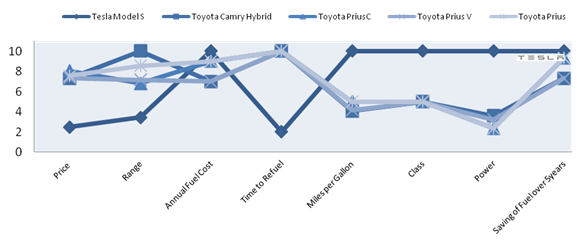

Figure 3: Product Value Curve Tesla v HEVs Source: Office of Transportation & Air Quality, 2015

Source: Office of Transportation & Air Quality, 2015

The main difference between the Model S and hybrid cars are that hybrids use their petrol engines to charge their batteries and therefore do not need to be plugged in. This can be seen for instance here as the Tesla is uncompetitive in range and time to refuel. Two common issues customers have when considering purchasing a fully electric car, which experts believe are holding back the expansion of the battery electric vehicle market (Musk, 2015). Additionally, the graph shows how the Tesla is again uncompetitive in pricing when compared to hybrid electric vehicles, as with the BEVs this is a question of class. The Model S does outperform its main hybrid competitors considerably in relation to miles per gallon, in addition to power and being more efficient regarding fuel over a 5 year period.

4.2.3. Tesla Model S vs Main Luxury Sedan Competitors

Figure 4: Product Value Curve Tesla v Luxury Sedans Source: Office of Transportation & Air Quality, 2015

Source: Office of Transportation & Air Quality, 2015

Luxury sedans have been included for comparison as they are of the same class of car and similar in price and performance. Battery electric cars emit no emissions other than those emitted by the power plant where the electricity is generated in order to charge them. As electricity is considerably cheaper than petrol in the USA and high performance, luxury vehicles are perceptually known for using above average amounts of fuel there are certain aspects in which the Tesla Model S outperforms its fossil fuel competitors. The annual fuel cost for a Tesla is less than a third of that for a car with similar performance specifications. The time to refuel and range however is again a point where any electric car is less competitive.

4.2.4 Summary of the Competition

The product value curves again reinforce the notion that Tesla has manages to create a product that has a rather unique market in a highly competitive industry. The company is able to be competitive in each of the defined markets individually but in each case the Model S offers something that its competitors do not. Tesla’s ability to forge a market where customers value both performance and environmental impact has been identified by some competitors and both BMW and Daimler have produced all electric premium vehicles. These cannot currently be taken as serious competitors as they have considerably lower specifications regarding range, time to refuel and miles per gallon for almost twice the cost of the Model S and have therefore been omitted from this report. Concepts of similar all electric luxury vehicles that could one day compete with Tesla have been shown by various auto-manufacturers at global car shows, however these potential entrants are still years away from production and it is unclear how viable the technology presented could be in a production vehicle (Debar, 2015).

5. Implications

The following implications have focus on enhancing Tesla’s current competitive abilities in the various markets in which it competes and should not be considered before the Gig factory becomes at least partly operational so that Tesla can deal with increased demand efficiently.

5.1. Battery Electric Vehicle (BEV) Market

Tesla is the current market leader in the BEV market in the USA but the Nissan Leaf is the world’s most popular BEV. The market demand as a whole is relatively small when compared with the hybrid or luxury vehicle markets in the USA. Fuel is considerably more expensive in Europe when compared to the USA and this influences buying trends in relation to BEVs.

Potential strategic options:

- For Tesla’s sales to increase in the USA, the potential customer base must increase also. This could be achieved through alternative marketing strategies aimed at first time buyers or partnerships with organizations such as The Union of Concerned Scientists who have recently published that 42% of American households could change to BEVs without changing their lifestyle (UCS, 2013).

- Tesla will only be able to compete with the Nissan Leaf with a car of similar body type. This may most effectively be done through the creation of a partnership with established manufacturers of sub-compact cars.

- Tesla may wish to focus future investments in infrastructure in areas where petrol and deasil is less affordable to the average consumer such as Europe and parts of Asia.

Table 4 summaries strengths and weaknesses of Tesla in BEV market. Table 4: Strengths and Weaknesses of Tesla

| Benefits | Limitations |

|---|---|

| Young first time buyers are not used to the reliance of fossil fuels and are more likely to adopt new technologies | While increasing the customer base Tesla will also increase demand for competitor’s vehicle. |

| Through partnerships Tesla technology can compete with other sub-compact cars on a global level with limited risk and limited investment | There are many established competitors in the sub-compact BEV market. |

| Tesla’s superior technology in regards to battery range, cost of battery production and charging times could make any sub-compact car more attractive to consumers than current market leaders. | Tesla has limited experience creating sub-compact cars. |

| Europe and Asia already have developed infrastructure regarding electric cars and increasing interest in them | Fuel prices are volatile and are not able to be controlled or accurately predicted by Tesla in the long term. |

5.2. Hybrid Electric Vehicle (HEV) Market

Toyota currently dominates the HEV market with a broad product offering. The HEV market is currently over 4 times the size of the BEV market in the USA. HEVs have range that Tesla is unlikely to be able to compete with without substantial technological advancement. Tesla considered going into the hybrid market by adding a fossil fuel powered range extender to the Model S but decided against it as it was not in line with the company’s ethos. Range anxiety and recharge times two common problems in the BEV market are not applicable in the HEV market.

Potential strategic option includes forming a partnership with an established producer of hybrid vehicles to compete directly with Toyota models. Table 5 summarises strengths and weaknesses of Tesla in HEV market. Table 5: Benefits and Limitations

| Benefits | Limitations |

|---|---|

| Forming a partnership would not tarnish Tesla’s brand with regards to the company’s attitude towards fossil fuels. | There is potential for Tesla to cannibals’ its sales of other models if the Tesla hybrid is of a comparable class to the Model S |

| Decreased risk when forming a partnership as knowledge and costs can be shared between firms | Additional competitors may have to be accounted for that are not covered in this report. |

| Tesla’s superior technology in regards to battery range, cost of battery production and charging times could make any hybrid car more attractive to consumers than current market leaders. | The Hybrid car industry is currently dominated by the world’s largest automobile manufacturer. |

| Tesla has previous experience operating as an original equipment manufacturer. | Toyota has the capital to adapt to a changing market rapidly. |

| A Tesla hybrid has the potential to move into uncontested market space of a high performance luxury hybrid in marketed and priced correctly. |

5.3. Luxury Sedan Market

The luxury sedan market is growing at a faster rate than the automobile market as a whole in the USA and China. The market is dominated by the German big three (BMW, Audi, Mercedes) in addition to Toyota owned Lexus. Tesla’s Model S is better than or equal to its similarly priced competitors in all factors apart from range and the time it takes to refuel.

4.2.2. Tesla Model S vs Main Hybrid Electric Vehicle Competitors (HEVs)

Figure 3: Product Value Curve Tesla v HEVs

Source: Office of Transportation & Air Quality, 2015

Luxury sedans have been included for comparison as they are of the same class of car and similar in price and performance.

Battery electric cars emit no emissions other than those emitted by the power plant where the electricity is generated in order to charge them. As electricity is considerably cheaper than petrol in the USA and high performance, luxury vehicles are perceptually known for using above average amounts of fuel there are certain aspects in which the Tesla Model S outperforms its fossil fuel competitors.

The annual fuel cost for a Tesla is less than a third of that for a car with similar performance specifications. The time to refuel and range however is again a point where any electric car is less competitive.

5. Implications

These implications focus on enhancing Tesla’s current competitive abilities in the various markets in which it competes and should not be considered before the Gig factory becomes at least partly operational so that Tesla can deal with increased demand efficiently.

5.1. Battery Electric Vehicle (BEV) Market

Tesla is the current market leader in the BEV market in the USA but the Nissan Leaf is the world’s most popular BEV. The market demand as a whole is relatively small when compared with the hybrid or luxury vehicle markets in the USA. Fuel is considerably more expensive in Europe when compared to the USA and this influences buying trends in relation to BEVs.

Potential strategic options:

- For Tesla’s sales to increase in the USA, the potential customer base must increase also. This could be achieved through alternative marketing strategies aimed at first time buyers or partnerships with organisations such as The Union of Concerned Scientists who have recently published that 42% of American households could change to BEVs without changing their lifestyle (UCS, 2013).

- Tesla will only be able to compete with the Nissan Leaf with a car of similar body type. This may most effectively be done through the creation of a partnership with established manufacturers of sub-compact cars.

- Tesla may wish to focus future investments in infrastructure in areas where petrol and deasil is less affordable to the average consumer such as Europe and parts of Asia.

able 4 summaries strengths and weaknesses of Tesla in BEV market.

Table 4: Strengths and Weaknesses of Tesla

| Benefits | Limitations |

|---|---|

| Young first time buyers are not used to the reliance of fossil fuels and are more likely to adopt new technologies | While increasing the customer base Tesla will also increase demand for competitor’s vehicle. |

| Through partnerships Tesla technology can compete with other sub-compact cars on a global level with limited risk and limited investment | There are many established competitors in the sub-compact BEV market. |

| Tesla’s superior technology in regards to battery range, cost of battery production and charging times could make any sub-compact car more attractive to consumers than current market leaders. | Tesla has limited experience creating sub-compact cars. |

| Europe and Asia already have developed infrastructure regarding electric cars and increasing interest in them | Fuel prices are volatile and are not able to be controlled or accurately predicted by Tesla in the long term. |

5.2. Hybrid Electric Vehicle (HEV) Market

Toyota currently dominates the HEV market with a broad product offering. The HEV market is currently over 4 times the size of the BEV market in the USA. HEVs have range that Tesla is unlikely to be able to compete with without substantial technological advancement. Tesla considered going into the hybrid market by adding a fossil fuel powered range extender to the Model S but decided against it as it was not in line with the company’s ethos. Range anxiety and recharge times two common problems in the BEV market are not applicable in the HEV market.

Potential strategic option includes forming a partnership with an established producer of hybrid vehicles to compete directly with Toyota models. Table 5 summarizes strengths and weaknesses of Tesla in HEV market.

Table 5: Benefits and Limitations

| Benefits | Limitations |

|---|---|

| Forming a partnership would not tarnish Tesla’s brand with regards to the company’s attitude towards fossil fuels. | There is potential for Tesla to cannibalise its sales of other models if the Tesla hybrid is of a comparable class to the Model S |

| Decreased risk when forming a partnership as knowledge and costs can be shared between firms | Additional competitors may have to be accounted for that are not covered in this report. |

| Tesla’s superior technology in regards to battery range, cost of battery production and charging times could make any hybrid car more attractive to consumers than current market leaders. | The Hybrid car industry is currently dominated by the world’s largest automobile manufacturer. |

| Tesla has previous experience operating as an original equipment manufacturer. | Toyota has the capital to adapt to a changing market rapidly. |

| A Tesla hybrid has the potential to move into uncontested market space of a high performance luxury hybrid in marketed and priced correctly. |

5.3. Luxury Sedan Market

The luxury sedan market is growing at a faster rate than the automobile market as a whole in the USA and China. The market is dominated by the German big three (BMW, Audi, Mercedes) in addition to Toyota owned Lexus. Tesla’s Model S is better than or equal to its similarly priced competitors in all factors apart from range and the time it takes to refuel.

Potential strategic options:

- Emulate the success surrounding the German big three by focusing on performance and highlighting the low depreciation of Tesla products.

- Perform a cost benefit analysis of competing within motorsports in order to strengthen brand image.

- Again form a partnership with organizations such as The Union of Concerned Scientists to highlight the cost savings both financially and environmentally while emphasising competitive performance.

- Develop a Blue Ocean Marketing approach emphasizing both performance and sustainability aimed at young professionals (Kim and Mauborgne, 2014).

Table 6 summarizes strengths and weaknesses of Tesla in Luxury car market

Table 6: Benefits and Limitations of Tesla in Luxury car market

| Benefits | Limitations |

|---|---|

| Tesla already differentiates itself considerably in this market. | Falling fuel prices in the USA means fossil fuel powered cars are becoming cheaper to |

| Motorsports could potentially highlight Tesla’s engineering capabilities in addition to being a platform for performance innovation. (Formula E an emerging sport) | The German big three have extremely well established reputations and success may not be easily emulated |

| Partnerships with organisations that promote BEVs will be relatively inexpensive. | Participating in motorsport may divert resources away from the main focus of the company. |

| Focusing specifically on young professionals focuses on groups that are typically part of the innovators and early adopters and are more likely to embrace new technology (Roger, 2003). | Blue Ocean Marketing Strategy must be implemented correctly to effectively create an uncontested market of the environmentally conscious car enthusiast. |

Conclusion

Tesla Motors was established by creating a unique market for wealthy sports car enthusiasts who shared the company’s vision of sustainability and reducing fossil fuel use. The company has since expanded its product line to include the Model S, which competes successfully in both the battery and hybrid electric vehicle markets as well as the luxury sedan market.

To develop products that can reach a wider audience, Tesla applies Roger’s diffusion of innovation theory (2003). The company also focuses on controlling costs through vertical integration, product innovation, and strategic partnerships.

In order to maintain its competitive edge, Tesla must:

- Continue seeking out untapped market opportunities

- Promote its distinctive product features

- Develop its brand image as a luxury electric car manufacturer

Additionally, it is important for Tesla to promote the overall battery electric vehicle market by integrating relevant partnerships into its corporate strategy.

- Autoalliance (2015), U.S. car sales from 1951 to 2014 (in units), [Online] Available at: https://www.statista.com/statistics/199974/us-car-sales-since-1951/ (Accessed on: 30th October 2015)

- Chan, C.C. and Wong, Y.S. (2004), “Electric vehicles charge forward, Power and Energy Magazine”, IEEE, Vol. 2, No. 6, pp. 24-33. https://doi.org/10.1109/MPAE.2004.1359010

- Cobb, J. (2015), September 2015 Dashboard [Online] Available at: https://www.hybridcars.com/september-2015-dashboard/ (Accessed on: 1st November 2015)

- Cuthbertson, A. (2014), Tesla to Create World’s Largest Lithium-ion Battery Factory [Online] Available at: https://www.ibtimes.co.uk/tesla-create-worlds-largest-lithium-ion-battery-factory-1441095 (Accessed on: 1st November 2015)

- DeBord, M. (2015), Tesla might finally be facing competition from powerful rivals [Online] Available at: https://www.techinsider.io/tesla-might-have-to-worry-2015-9 (Accessed on: 8th November 2015)

- Economist. (2009), A giant falls [Online] Available at: https://www.economist.com/node/13782942 (Accessed on: 1st November 2015)

- EDTA. (2015), Electric Drive Sales Dashboard [Online] Available at: https://electricdrive.org/index.php?ht=d/sp/i/20952/pid/20952 (Accessed on: 31st October 2015)

- GoodCarBadCar.net. (2015), U.S. luxury car market share in 2014, by brand [Online] Available at: https://www.statista.com/statistics/287620/luxury-vehicles-united-states-premium-vehicle-market-share/ (Accessed on: 30th October 2015)

- IHS Automotive. (2014), SUVs and Crossovers Overtake Sedans to Become Most Popular Vehicle Body Style in the U.S. [Online] Available at: https://press.ihs.com/press-release/automotive/suvs-and-crossovers-overtake-sedans-become-most-popular-vehicle-body-style- (Accessed on: 31st October 2015)

- Kim, W. and Mauborgne, R. (2014), Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant, Boston: Harvard Business School Publishing Corporation

- Libby, T. (2014), Who is buying the Tesla Model S? [Online] Available at: https://blog.ihs.com/who-is-buying-the-tesla-model-s [Accessed on 31st October 2015]

- Murtha P., (2015), BMW, Mercedes Vie for U.S. Sales Crown in Upbeat Premium Car Market [Online] Available at: https://www.jdpower.com/cars/articles/auto-sales/bmw-mercedes-vie-us-sales-crown-upbeat-premium-car-market (Accessed on: 1st November 2015)

- Musk, E. (2015), Visions for Tesla, the auto industry and self-driving Teslas (Interview in Denmark). [Online] Available from: https://www.youtube.com/watch?v=bl5vLC3Xlgc (Accessed on: 30th October 2015)

- Musk, E. (2004), The Secret Tesla Motors Master Plan (just between you and me) [Online] Available at: https://www.tesla.com/en_GB/blog/secret-tesla-motors-master-plan-just-between-you-and-me (Accessed on: 30th October 2015)

- Office of Transportation & Air Quality. (2015), Compare Hybrids Side-by-Side [Online] Available at: https://www.fueleconomy.gov/feg/hybrids.jsp (Accessed on: 8th November 2015)

- Pyper J., (2015), As European Electric Vehicle Sales Spike, Demand Slows in the US [online] Available at: https://www.greentechmedia.com/articles/read/european-ev-sales-spike-as-the-u.s.-market-lags (Accessed on: 30th October 2015)

- Read, R. (2013), GM Follows Tesla’s Lead, Plans To Sell Directly To Online Shoppers. [Online] Available at: https://www.thecarconnection.com/news/1087492_gm-follows-teslas-lead-plans-to-sell-directly-to-online-shoppers (Accessed on: 2nd November 2015)

- Rogers, E.M. (2003), Diffusion of Innovations. 5th ed. New York: The Free Press.

- Supercharge. (2015), Supercharge map [Online] Available at: https://supercharge.info/ (Accessed on: 10th November 2015)

- Tesla Motors. (2010), Press Release, Strategic partnership: Daimler acquires stake in Tesla. [Online] Available at: https://www.tesla.com/en_GB/blog/strategic-partnership-daimler-acquires-stake-tesla (Accessed on: 22nd October 2015)

- Tesla Motors. (2014a), Press Release, Panasonic and Tesla Sign Agreement for the Gigafactory. [Online] Available at: https://www.tesla.com/en_GB/blog/panasonic-and-tesla-sign-agreement-gigafactory (Accessed on: 23rd October 2015)

- Tesla Motors. (2014b), Planned 2020 Gigafactory Production Exceeds 2013 Global Production [Online] Available at: https://www.tesla.com/sites/default/files/blog_attachments/gigafactory.pdf (Accessed on: 8th November 2015)

- Tesla Motors. (2015), Investors Overview [Online] Available at: https://ir.tesla.com/#tab-quarterly-disclosure (Accessed on: 30th October 2015)

- Trudell, C. and Homesman, A. (2014), Why the Tesla-Toyota Partnership Short-Circuited [Online] Available at: https://www.bloomberg.com/bw/articles/2014-08-07/tesla-toyota-deal-to-develop-electric-suv-fizzles (Acessed on: 22nd October 2015)

- UCS. (2013), Millions of Americans Could Use an Electric Vehicle [Online] Available at: https://www.ucsusa.org/clean_vehicles/smart-transportation-solutions/advanced-vehicle-technologies/electric-cars/bev-phev-range-electric-car.html#learn (Accessed on: 20th November 2015).